Managing Shipping and Logistics for Small Businesses

Shipping packages from home as a small business owner can be a daunting task. With uncoordinated user flows, little/inaccurate package tracking data, and a lack of assistance, there is a lack of efficiency in helping small business owners get their shipments from their homes to their customers

In this project, we sought to find solutions to streamline the shipping and logistics process and enhance the user experience through a customizable, AI-powered shipping dashboard

Mentored By

Sean Perryman

sperryman@ups.com

Problem

The main points of contention can be condensed into the following main findings on end-to-end MSE considerations in shipping and logistics:

- Businesses lack agency in the shipping process

- Price and ease of UPS services matter most

- Businesses want access to resources that can help them grow and scale

- Businesses want dedicated customer support (e.g. a representative)

Small businesses want to trust in the carrier’s timely delivery and transparency, especially on accurate shipment and tracking data and clear, frequent communication

*MSE= micro and small business enterprise

Background Research

Stakeholder Analysis

conducted to understand the network in which small business owners operate

Competitor Analysis

conducted to leverage the weaknesses of competitors in order to develop a more intuitive user experience for UPS users

Methods

01 Website Walkthrough

Information Goals:

•Review the structure and Information architecture of UPS websites.

•Have a thorough understanding of the paths and steps to completion of tasks within the UPS website, to expose areas in which to increase user engagement and experience.

Method Justification

•Understand how the UPS website's features, functions, and content support the site’s information categories.

•Experience how users get to desired pages, in how many ways, and how contents and pages connect to inform Task Analysis and Competitive Analysis

Other methods cannot measure the users’ exact workflow(s) and experience on the website specifically

Constraints

•In our case, the walkthrough was grounded in the researchers’ experiences and actions, rather than target groups.

•Website walkthroughs measure usability and accessibility, but not the user groups’ motivations and actions

Method Details

- Use the official UPS website to learn how micro and small businesses use UPS by doing it myself and watching others do it on YouTube.

- Go through the website to get information architecture of the whole website.

- Learn how different pages and interactions can help users with package shipping tasks.

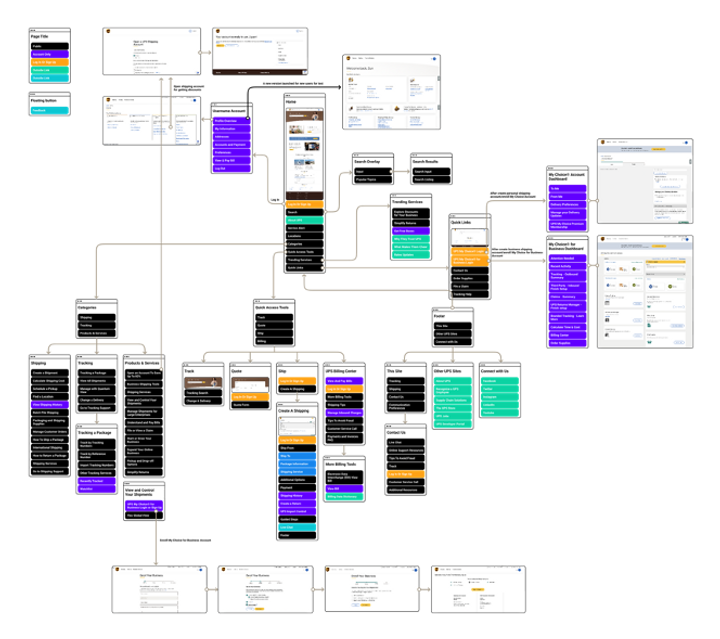

- Create a sitemap with some page screenshots to show the different connections between different pages.

Interaction Map

-

3 tiers of relationships with UPS, including username, shipping account, My choice/My choice for Business.

-

A lot of buttons branch go into too many options

-

No direct information for business users from the home page.

-

Support FAQ table for main functions and Live customer support for users.

-

We examined the relationship between different pages and discussed if the UPS website provides a reasonable path to pointed user tasks.

-

We did not find the accessible service throughout the walkthrough

-

The UPS site offers a wide variety of customer support options for businesses, but finding resource pages requires extensive website navigation.

02 Task Analysis

Information Goals

Itemize end-to-end experience of shipping an item to understand constituent steps

Understand users’ high-level decisions at each stage of shipment

Method Justification

-

•Particularly for our problem space, there is one dominant and universal task (shipping orders) around which all other concerns revolve.

-

•Analyzing this task provides the foundation for informing lower-level user experiences.

-

•Other methods do not structurally leverage or highlight the prominence of this single foundational task.

Constraints

-

Relatively divorced from the user’s environment, personal motivations, and individual circumstances.

-

Only provides insight into the functional decisions made by users (e.g. going to X to do Y), not their “higher-order”, emotional, and/or forced decisions

Method Procedures

-

The investigation was based on findings from the Contextual Inquiry and background research (watching videos and browsing small business forums).

-

Built as a team iteratively – started with an anachronistic list of all goals, sorted goals, then listed + sort each of the constituent tasks (plans) within each goal.

-

Based on constituent tasks of each goal, discuss which goals are critical decision points for MSEs

-

Centered findings around informing survey structure and questions

-

9 key steps, starting from locating an order to managing returns + claims (earliest and latest steps identified in background research)

-

Goal 3, deciding the platform on which to manage orders and the shipping process, has the greatest number of possible subtasks

-

Influenced by the business model and goals

-

Goal 3 and Goal 8 are the most variable, containing several different options that can drastically change the business model

-

Depending on combinations of carriers, selling platforms, and order management platforms used, tracking model is distinctly located

03 Contextual Interview

Method Details

-

Recruitment was conducted by identifying family and friends who were small business owners who either had their business currently running or could walk us through the steps they made when shipping a parcel.

-

The contextual interview was broken into two sections: the priming/interview section and the observation section.

-

Interviews were conducted virtually while the participant was in the setting where they conducted business.

-

Participants shared general information about the history of their business and shipping practices. Then they walked us through the physical and online services and tools they use right after they receive confirmation of an order.

-

Field notes were taken while the participants took us through each step of the shipping process.

-

Findings were later collected and helped inform our task analysis.

-

During the stage, we made regular interjections to get context on why certain decisions were made, understand what the MSE was thinking, and probe them on additional questions we had.

-

The study involved participating in a remote task-based interview, in which we observed users’ workflow in using online platforms to sell and ship items.

-

Studies lasted about 2 hours in total.

-

Experience Map breaks down the shipping process into 5 steps from receiving an order to dropping it off at the post office.

-

We synthesized the shipping process and the overall sentiments of CI participants to create an experience map that breaks down the relevant steps of the shipping process.

-

The map includes questions, feelings, and decision processes MSEs have along the way, providing context to the decisions behind of shipping a package.

-

Users value being highly involved with the status of their parcels.

-

Users frequently consider convenience, reliability, and cost.

04 Stakeholder Interview

Information Goals

-

Understand what UPS Store services provide distinctly from online services

-

Understand the relationship between users and UPS Stores through the perspective of the stakeholders who interact and work with them

Method Justification

-

Was able to physically visit the stakeholder site and directly question store managers about how they operate their store and their relationship(s) with businesses

-

Other methods cannot supply the same face-to-face interaction with UPS Stores’ services.

-

Other methods would not allow us to directly question and gain the perspective of client-adjacent, but still customer-related, UPS services.

Constraints

-

The stakeholders (UPS Store managers) are evidently not our target users and operate in the interests of the UPS Store franchise, so they cannot give the most transparent and accurate opinions on our users’ wants and needs.

Method Details

-

Developed interview guidelines using the findings from Website Walkthrough and Task Analysis.

-

Website Walkthrough: Informed the UPS-specific services to compare with the store services

-

Task Analysis: Informed the range of questions to span the whole shipping and logistics process

-

-

Recruitment: Walked into UPS Stores cold and made an appointment with the store manager(s).

-

Interview: 1 hour each, with sessions in person.

-

Generated affinity map to analyze the stakeholder interview data.

-

Used affinity Map Method

-

Generated the sticky notes from the transcript from the recording.

-

Sorted the notes into top-level categories and then sorted each of those categories into subcategories.

-

Found pain points in collaboration between users and UPS

05 Survey

Information Goals

-

Primarily understand how and why users decide on their selling, order management, and/or carrier platforms

-

Understand what stages of the shipping process users prioritize, and what features within each stage.

Method Justification

-

Needed to capture a wide variety of MSE environments to understand which decisions in and stages of shipping are universally important & and challenging.

-

For maximizing the volume of raw data, the survey is the best tool above all others

-

We wanted quantitative data on what decisions, features, and services, users prefer, and survey data can be measured quantitatively very quickly

Constraints

-

Focuses on breadth over depth which means each individual data point is not particularly insightful on its own, unlike methods like the contextual inquiry

-

Data can be skewed and/or present an incomplete picture depending on the populations that fill out the survey, recruitment efforts, etc.

Method Details

-

Questions centered around how businesses decide on selling and order management platform

-

Developed survey structure using stakeholder interview analysis, CI findings, and task analysis

-

Stakeholder analysis: informed in-store questions

-

CI: informed general survey sections TA: revealed decision points on which we needed to ask participants

-

-

Recruitment: Snowball sampling, in-person visits (farmer’s markets), private messaging, posting on social media, email lists

-

Quantitative data: generated Qualtrics report w/ graph visualizations, descriptive statistics for all rating + demographic questions

-

Qualitative data: grouped free responses by keyword (not enough free response answers to formally code) in a spreadsheet

-

Most businesses are micro-businesses, working in crafts and operating out of home

-

Most businesses are on E-commerce and 3PL platforms for order management

-

Most businesses choose their carrier based on rate comparison and reliability

-

Package tracking generated the most free-text response keywords out of any other aspect of the process

06 User Interviews

Information Goals

-

Develop a deeper understanding of the results of the survey

-

Gather general, ad hoc sentiments on the shipping process as a whole

Method Justification

-

Allows for more interaction with the users we are designing for

-

More detailed understanding of how the pain points found in the survey impact the user and their business.

-

Provide knowledge of factors that cannot be measured unless in the environment

-

Ask questions based on the users’ responses to other questions

Constraints

-

Had to go by the users’ availability and space

-

Could only interview a certain number of people unlike surveys

Method Details

-

Developed preliminary interview questions using what was learned about the specific pain points of our users in the survey

-

Went to a pop-up gathering for small businesses in Atlanta Piedmont Park and talked with businesses in regard to their experiences in order management, delivery preferences, carrier choice, shipment tracking, and resources offered by the carrier

-

Much of what was said during interviews was similar to what we found in the survey but with added detail and explanations that could not be seen in the survey.

-

Used Google Sheets to organize summarized statements and code for themes

Steps:

-

First organized data based on how they relate to the survey findings

-

Began creating second-level data and organizing information based on one-word themes

-

Created key findings based on second-level data

Results

Overall findings:

Convenience

-

MSE owners are generally pressed for time and need to be able to ship out orders efficiently (easy-to-access store, Dropboxes)

-

At a feature level, MSE owners will tend to use the platforms that connect most intuitively with their selling workflow

Reliability

-

Reliable package tracking & and delivery (and the visibility of such) is a key priority for the MSE

Agency

-

MSEs want to maximize control of the shipment process

-

Dropping off over picking up, label making in store (CI), so customers can witness handoff themselves

-

Lack of transparency can damage trust between MSE-customer and MSE-carrier

Business Model & Context

Business characteristics (maturity, model) dictate their choice of selling and order management platform, and thus their shipment and logistics processes

Design Requirements

Based on our findings, we developed 7 design requirements:

-

The system should display order management tools on a centralized dashboard immediately to user.

-

The system should allow for straightforward comparisons of shipping rates.

-

The package tracking system data should visualize the package's journey for users to easily understand and interpret.

-

The system should redesign the pickup process to make it more reliable and safe.

-

The system should encourage direct interaction with carriers' online and in-person services in shipping an item.

-

The system should communicate consistently to small business owners about advertising and branding services for growth.

-

The system should reorganize claim management guidance to be more transparent and actionable for businesses.

Personas + Journey Maps

Sketches

Idea 1: Social Media Integration

-

Primarily addresses: DR 5

-

Goal: Integrating a UPS.com shipping plugin into Instagram Shop or Facebook Marketplace, in order to ease the shipping decision-making for MSEs selling on social media.

Function/Walkthrough:

-

The user selects social media platforms on which they sell (Screen 1)

-

Based on selected platforms, user can import orders from their shop

-

The user views the item’s estimated shipment date, recommended shipping speed, and applicable discounts

-

The user follows the standard shipping workflow on UPS.com after the integration

Features:

-

Saved “shipping channels”

-

Auto-import of recent shop orders

-

Recommended shipment speed & and instant rate based on item metadata from the shop

Accessibility Considerations:

-

Mobile devices are not particularly inclusive of older populations that do not have fluency with mobile technologies

-

Font size and type, color palette

Idea 2: Smart-UPS Dropbox

-

Primarily addresses: DR 1, 5

-

Goal: Offer a physical, secure, and accessible dropbox for MSEs relying on drop-off to handoff packages.

Function/Walkthrough:

-

Kiosk-style drop box located in designated UPS locations (e.g. Access Points, Locker)

-

The user places the box in the box slot

-

The user receives an instant quote for the box based on weight and dimension

-

The user decides whether or not to complete the shipment with UPS

-

The user submits payment through the kiosk (on a mobile device, not directly on a kiosk)

-

The user drops off their package

Features:

-

Instant and automatic quote calculator

-

Asynchronous payment (billed to the user later and on a separate device)

Accessibility Considerations:

-

Height of Dropbox: can users in wheelchairs access the screen? Possibly make the height adjustable

-

Screen tilt: the screen should be vertical (not tilted) to accommodate users at any height

-

Payment information: there should be a secure way to pay without a mobile device at the drop box (e.g. printed payment code to then pay at home)

-

Font size and type, color palette

Idea 3: Tracking Visualization

•Primarily addresses: DR3, 5

•Goal: Make tracking information available on UPS.com account more transparent, visual, and granular to inform MSE owners of every stage of their process.

Function/Walkthrough:

•Visualization of tracking map, with approximate location of driver

•Time and date details for individual shipments in transit

•Email and/or text notifications for delivery updates

•Picture confirmation of delivered package

Features:

•Timestamped tracking for in-transit packages

•Visualization

•Instant notifications for successful delivery, delivery issues

•Immediate visual confirmation of delivery

•Accessibility Considerations:

•Visualizations should not be overly complex so as to require advanced browsing and/or software.

Font size and type, color palette

Idea 4: Personalization

-

Primarily addresses: DR1, 2, 3, 5, 6, 7

-

Goal: Create a centralized, personalized dashboard on UPS.com utilizing a widget-based layout that displays custom information tailored to the MSE’s shipping and business profile. Encourage MSEs to create a 6-digit payment account with UPS.com.

Function/Walkthrough:

•Dashboard with information widgets on various categories, such as shipping analytics, live tracking, and recommended supplies

•Add/edit/resize/remove widgets on the dashboard page

•Click on any individual widget to go to the page containing information for that widget within the UPS.com sitemap

Features:

-

Resizable widgets selected from the new UPS widget “library”

-

“UPS Family” displays and connects MSE owner to UPS Store & UPS pickup driver, integrating Store features with UPS.com

-

Smart recommendations provide business discounts, supply recommendations, etc. based on user’s inputted business profile and shipping history

Accessibility Considerations:

-

Font size and type, color palette

-

Advanced widget functionality may be too difficult to use for older users.

Wireframes

Part 1: Dashboard Wireframe

Satisfies: WR 1, 2, 3, 5, 6, 7

Description:

-

Our dashboard wireframe incorporates editable widgets, including Order Management, Recent Activity, Claims, Returns, Live Tracking, In-Store Service, Shipping Supplies, and Shipping Statistics, to allows users to quickly view different sections.

-

Users can edit widgets’ positions and can remove or add the widgets with their widget library.

Alignment with Design Goals:

-

Addresses the goal of enhancing user clarity and efficiency.

-

Aims to help users stay organized and make the most of their dashboard.

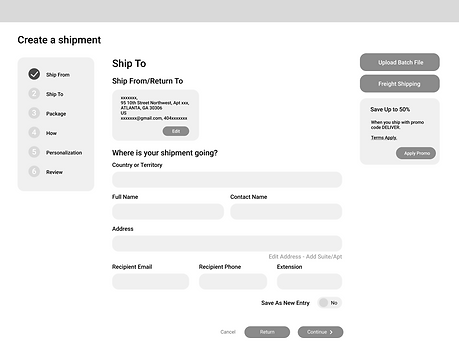

Part 2: Create a Shipment Wireframe

Satisfies: WR 1, 2, 4, 7

Description:

-

Users can autofill shipment details based on their preferences.

-

Receive recommendations for shipment services and package options.

-

Provide users more clear and accessible business discounts so that they can use promotions easily.

Alignment with Design Goals:

-

Simplify and expedite the shipment creation process using the recommendations and personalization feature.

-

Ensures that users can effortlessly create shipments with minimal effort.

Expert Evaluation

-

Goal: Understand what design decisions improved and hindered usability

-

Used heuristic evaluation method with 5 UPS UX researchers

-

Evaluated prototype on Nielsen’s Heuristics for three tasks

-

Selected 6/10 heuristics based on relevance to prototyped interactions

-

Analyzed evaluation data using affinity map

-

Extracted expert evaluation findings on usability by task

Design Review

-

Goals: Evaluate how well our prototype fulfills UPS design language and standards

-

Conducted with UPS Design team, UX researchers, and various stakeholders

-

Pitched prototype, main user flows, and features within each flow

-

Optional exit survey at end

-

-

Analyzed evaluation data in Issues/Recommendations charts sorted by feature

User Testing

Information Goals:

-

Assess the implementation of our expert evaluation and design review feedback

-

Iterate our prototype based on users’ reported usability issues, design preferences, and performed actions / interactions

Protocol:

-

Recruitment: Convenience sampling, in-person recruitment at markets

-

Tested 15 users on 5 tasks within 1-hr remote session

-

Deployed post-task questions and exit interview

Analysis:

-

Affinity mapped to determine major takeaways by task

-

Statistics for task completion + quantitative data

-

Younger business owners completed tasks at higher rates than older business owners

-

Task 3 (shipment management view) and Task 4 (supplies recommendations) had less success rates at 100%

-

Younger business owners completed tasks at higher rates than older business owners

-

Task 3 (shipment management view) and Task 4 (supplies recommendations) had less success rates at 100%